Managing customer inquiries while handling sensitive financial transactions? ThriveDesk’s AI customer service helps financial institutions answer questions about accounts, services, and procedures automatically. Our AI tools provide instant responses about your banking products, security protocols, and service features – even during high-volume periods. Improve customer satisfaction with responsive communication while your staff focuses on complex financial operations and personalized service.

ThriveDesk AI

AI Customer Service Platform

forBank & Credit Union

Trusted by

Support

Enhance Your Financial Institution with Smart AI

ThriveDesk AI transforms customer communications for banks and credit unions by providing immediate responses to common inquiries. Our solutions handle everything from account information to service explanations, letting your financial professionals focus on high-value transactions and relationship building.

Instant Account Information

Provides appropriate details about balances, transaction history, and statement availability.

Banking Product Explanations

Clearly communicates features of checking, savings, loans, and investment offerings.

Security Procedure Guidance

Shares authentication protocols, fraud prevention measures, and protection best practices.

Digital Banking Navigation

Helps customers use online platforms, mobile apps, and self-service banking tools effectively.

Automate your customer support

loved by 2,000+ startups

Use Cases

AI-Driven Customer Support for Financial Institutions

ThriveDesk AI helps banks and credit unions deliver exceptional service while maintaining security and regulatory compliance. Our tools ensure customers get fast, accurate information while your staff focuses on specialized financial services.

Transaction Troubleshooting

Provides guidance for resolving common issues with deposits, transfers, and payments.

Fee Information Distribution

Offers transparent details about service charges, account costs, and transaction fees.

Card Management Support

Assists with credit and debit card activation, replacement, and security features.

Branch and ATM Location Guidance

Helps customers find convenient service points, hours of operation, and available features.

Application Status Updates

Communicates progress on account opening, loan approval, and service enrollment.

Document Requirement Details

Clearly explains paperwork needs, identification verification, and information submission procedures.

Transform Bank & Credit Union with AI

Sign up for ThriveDesk today and boost your workflows, customers, and team with AI-driven solutions. Train your first chatbot for free with a 7-day trial—no credit card needed!

loved by 2,000+ startups

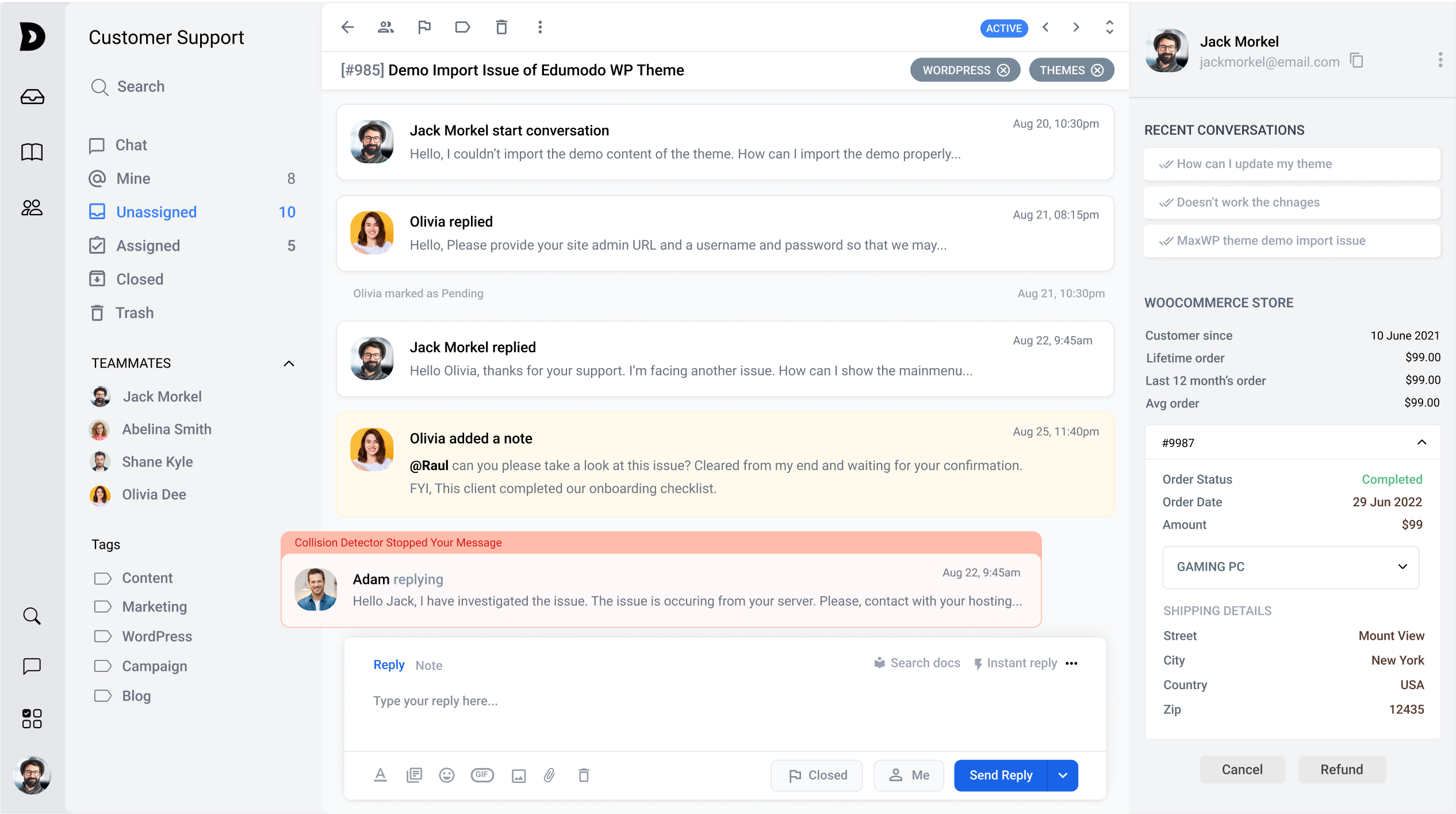

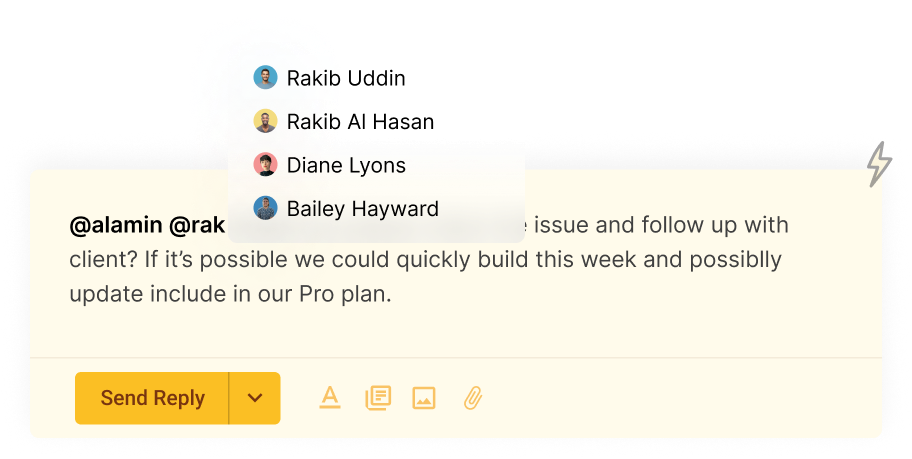

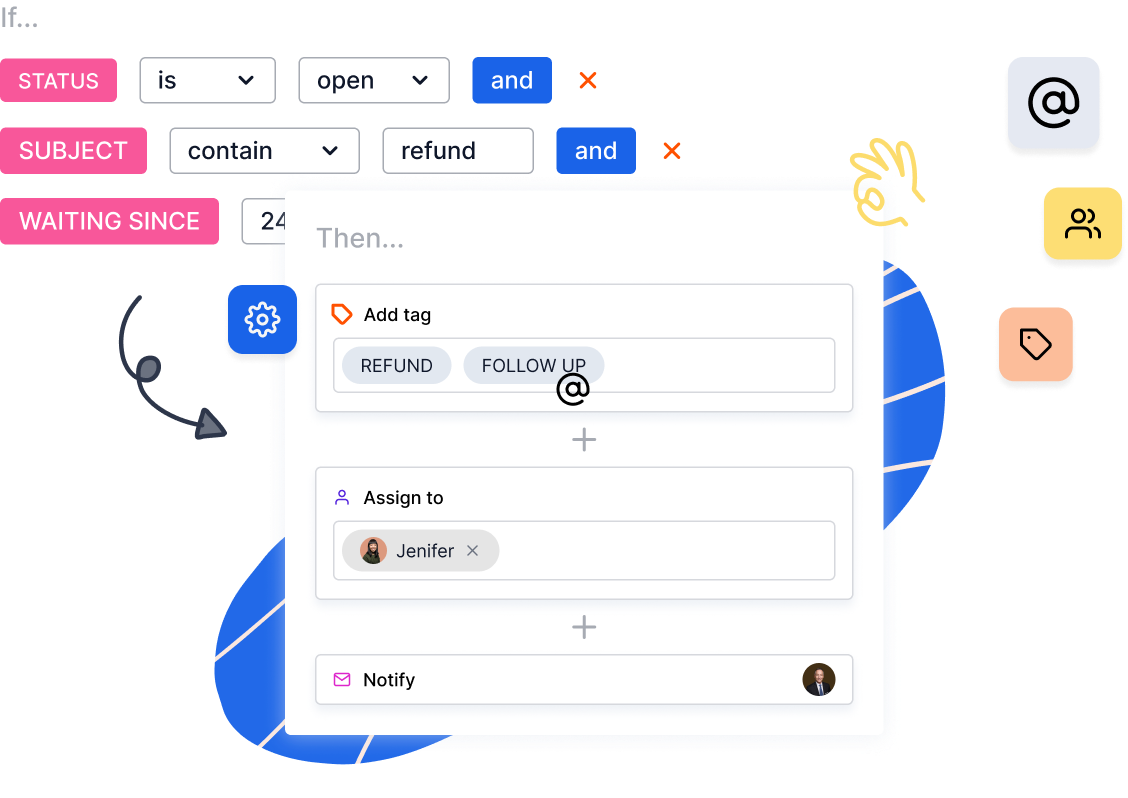

ThriveDesk has everything your team need to solve customer issues, faster

Everything you need to elevate your team’s email management and make them more productive, whether you have a team of 5 or 50.

Spam filtering

Remove clutter by automatically directing spam messages to a spam folder.

Default status update

Automatically update the status of tickets as ‘Pending’, ‘Active’, ‘Closed’ as soon as a team member opens it or makes any changes to it.

Multi-channel support

Support using email, live chat, contact form & API.

Auto BCC

Automatically send a copy of all outgoing conversations to a specified email address.

Canned replies

Maintain and retrieve information about past transactions of any customer who has interacted with your company.

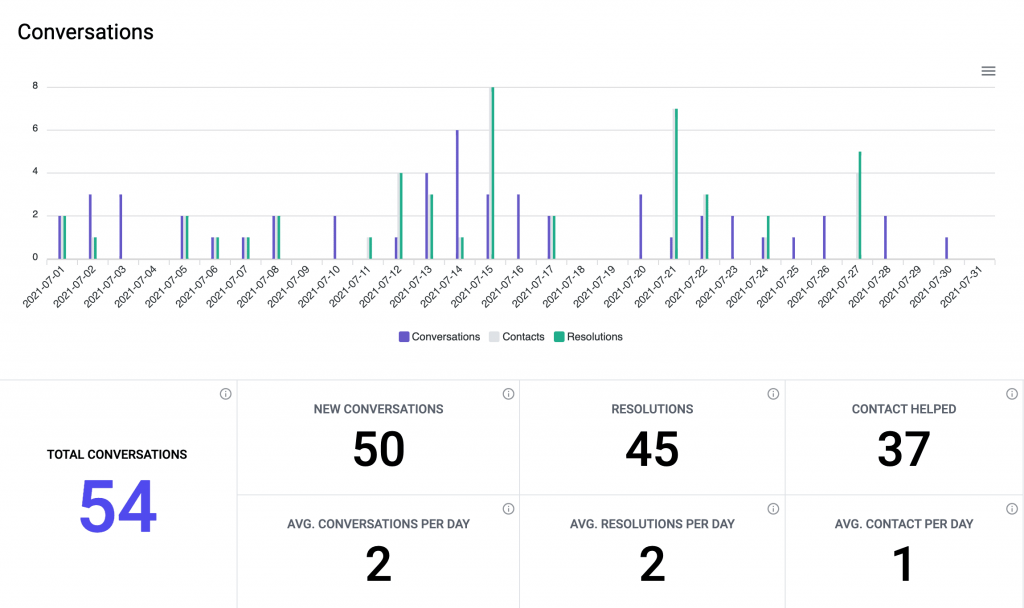

Conversation report

Understand your team’s bandwidth and the biggest issues faced by your customers. Learn key metrics like: Number of conversations received vs closed, When your team is the busiest and which agent is performing the worst.

Snooze

Have tickets reopen automatically at a specified time in the future (similar to the snooze feature in your phone’s alarm).

Keyboard shortcuts

Perform repetitive tasks quickly and manage ticket resolution on the fly by using keyboard shortcuts.

Contact history

Maintain and retrieve information about past transactions of any customer who has interacted with your company.

Happiness report

You can view the overall happiness score of the service and also the individual happiness score of each member through the happiness report. The report also provides reasons for the ratings and reviews posted by customers.

Company report

Get insights on how much of your company’s sales revenue was influenced by ThriveDesk. You can also use the company report to gain useful insights on trends and problem areas to optimize your processes better.

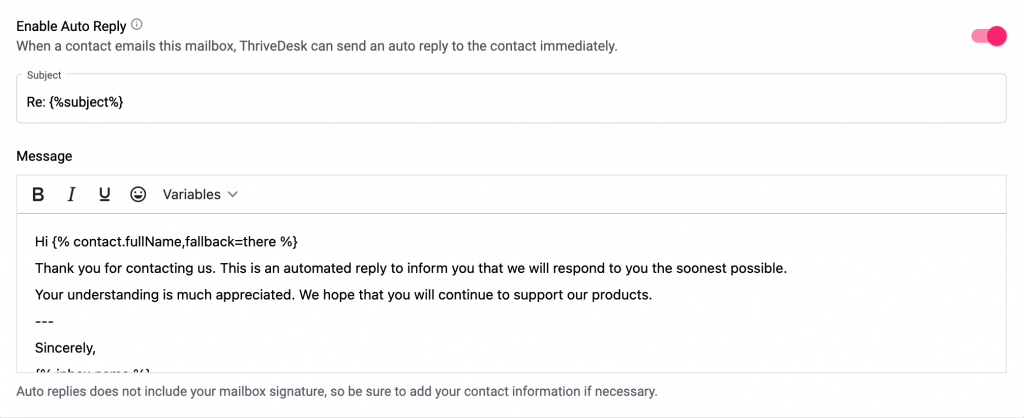

Auto-responders

Set up automated acknowledgement emails or other auto-responders once a ticket is submitted.

The most vital step to ensure customer satisfaction is getting an automated acknowledgement email set up as quickly as possible after the submission of a new ticket. This allows customers to feel more confident knowing their issue has been logged with us immediately and we're taking care of it right away!

The most vital step to ensure customer satisfaction is getting an automated acknowledgement email set up as quickly as possible after the submission of a new ticket. This allows customers to feel more confident knowing their issue has been logged with us immediately and we're taking care of it right away!

Performance report

This report shows you the number of conversations that were assigned to each team or team member, the average turnaround time per ticket and much more.

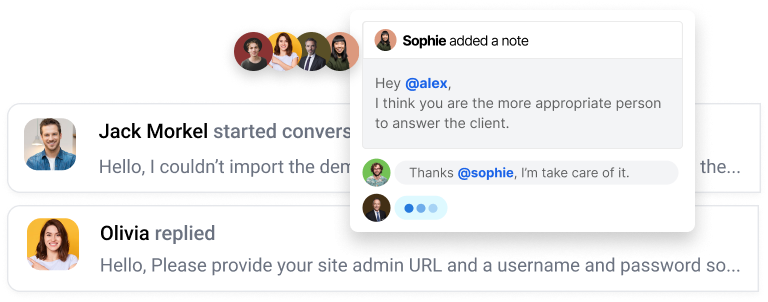

Conversation history

By tracking recent conversation history, you can ensure that your customer has a more personal and seamless experience even if the support agent is different each time.

Connect with your existing tech stack

Integrate ThriveDesk software with tools for marketing, analytics and growth that you’re already using. Streamline repetitive tasks to gain more time to focus on things that matter.

Get started for free