Managing borrower inquiries while facilitating financial inclusion? ThriveDesk’s AI customer service helps microfinance organizations handle questions about loan programs, repayment options, and financial education automatically. Our AI tools provide instant responses about your lending approach, support services, and application requirements – even during high-volume periods. Improve client satisfaction with responsive communication while your team focuses on expanding financial access and supporting economic development.

ThriveDesk AI

AI Customer Service Platform

forMicrofinance

Trusted by

Support

Enhance Your Microfinance Organization with Smart AI

ThriveDesk AI transforms borrower communications for microfinance institutions by providing immediate responses to common inquiries. Our solutions handle everything from loan information to payment questions, letting your financial inclusion specialists focus on community development and lending activities.

Instant Loan Information

Provides clear explanations of microfinance products, terms, and eligibility criteria.

Application Status Updates

Efficiently communicates progress on loan requests, approvals, and disbursement timelines.

Repayment Process Guidance

Outlines payment methods, schedule options, and transaction recording procedures.

Financial Education Navigation

Connects borrowers with appropriate resources, training opportunities, and skill development programs.

Automate your customer support

loved by 2,000+ startups

Use Cases

AI-Driven Borrower Support for Microfinance

ThriveDesk AI helps microfinance institutions deliver exceptional service while managing lending operations and community support. Our tools ensure clients get fast, accurate information while your team focuses on financial inclusion mission delivery.

Group Lending Information

Explains solidarity group mechanics, joint responsibility, and community borrowing structures.

Business Development Support

Shares details about entrepreneurial training, mentorship programs, and growth resources.

Savings Program Guidance

Communicates information about complementary savings opportunities, account features, and financial planning.

Document Requirement Details

Clearly outlines necessary paperwork, identification needs, and application materials.

Late Payment Management

Provides guidance on catching up, avoiding defaults, and maintaining good standing.

Impact Measurement Participation

Explains how borrowers can contribute to social impact assessment and program evaluation.

Transform Microfinance with AI

Sign up for ThriveDesk today and boost your workflows, customers, and team with AI-driven solutions. Train your first chatbot for free with a 7-day trial—no credit card needed!

loved by 2,000+ startups

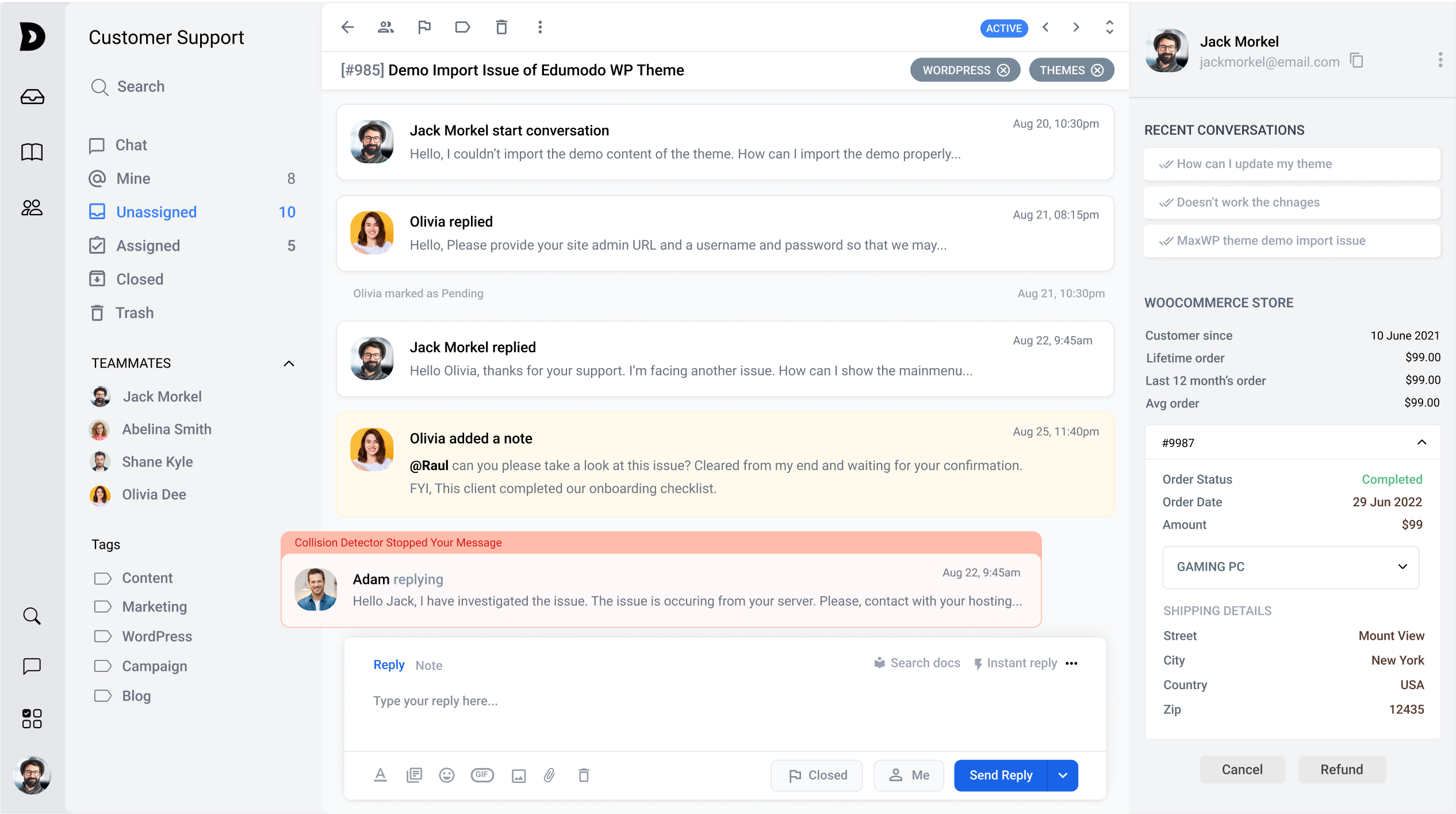

ThriveDesk has everything your team need to solve customer issues, faster

Everything you need to elevate your team’s email management and make them more productive, whether you have a team of 5 or 50.

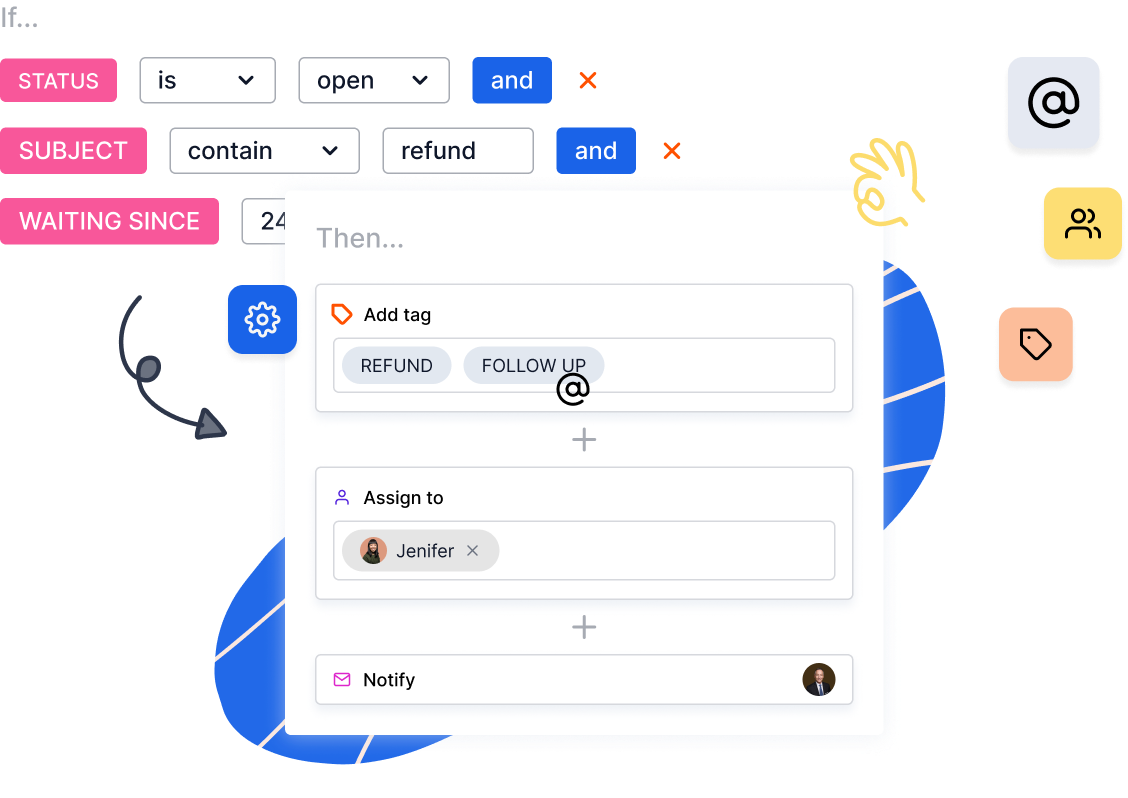

Spam filtering

Remove clutter by automatically directing spam messages to a spam folder.

Default status update

Automatically update the status of tickets as ‘Pending’, ‘Active’, ‘Closed’ as soon as a team member opens it or makes any changes to it.

Multi-channel support

Support using email, live chat, contact form & API.

Auto BCC

Automatically send a copy of all outgoing conversations to a specified email address.

Canned replies

Maintain and retrieve information about past transactions of any customer who has interacted with your company.

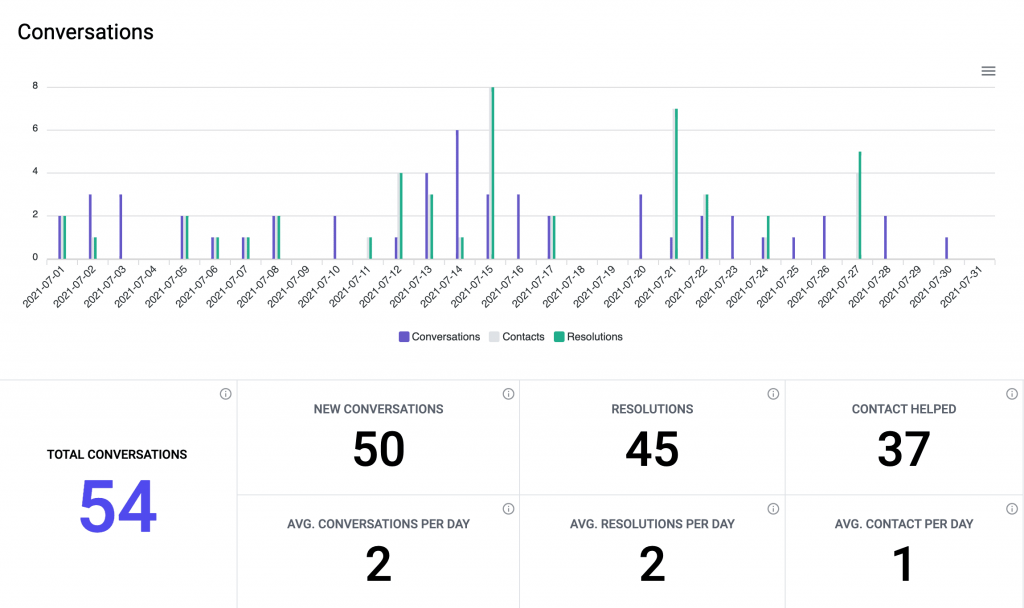

Conversation report

Understand your team’s bandwidth and the biggest issues faced by your customers. Learn key metrics like: Number of conversations received vs closed, When your team is the busiest and which agent is performing the worst.

Snooze

Have tickets reopen automatically at a specified time in the future (similar to the snooze feature in your phone’s alarm).

Keyboard shortcuts

Perform repetitive tasks quickly and manage ticket resolution on the fly by using keyboard shortcuts.

Contact history

Maintain and retrieve information about past transactions of any customer who has interacted with your company.

Happiness report

You can view the overall happiness score of the service and also the individual happiness score of each member through the happiness report. The report also provides reasons for the ratings and reviews posted by customers.

Company report

Get insights on how much of your company’s sales revenue was influenced by ThriveDesk. You can also use the company report to gain useful insights on trends and problem areas to optimize your processes better.

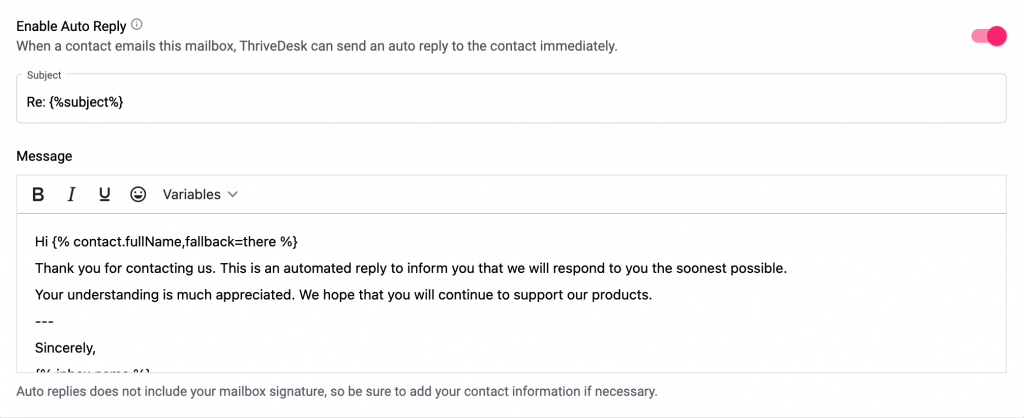

Auto-responders

Set up automated acknowledgement emails or other auto-responders once a ticket is submitted.

The most vital step to ensure customer satisfaction is getting an automated acknowledgement email set up as quickly as possible after the submission of a new ticket. This allows customers to feel more confident knowing their issue has been logged with us immediately and we're taking care of it right away!

The most vital step to ensure customer satisfaction is getting an automated acknowledgement email set up as quickly as possible after the submission of a new ticket. This allows customers to feel more confident knowing their issue has been logged with us immediately and we're taking care of it right away!

Performance report

This report shows you the number of conversations that were assigned to each team or team member, the average turnaround time per ticket and much more.

Conversation history

By tracking recent conversation history, you can ensure that your customer has a more personal and seamless experience even if the support agent is different each time.

Connect with your existing tech stack

Integrate ThriveDesk software with tools for marketing, analytics and growth that you’re already using. Streamline repetitive tasks to gain more time to focus on things that matter.

Get started for free